Recession? Maybe worse.Economy stumbles more

Expert says it could take years to recoverfrom financial crisis now going global

© 2008 WorldNetDaily

March 13, 20083

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=58831

Wall StreetWASHINGTON – It was another gloomy day on the financial markets, as more economic indicators suggested America's financial crisis is deepening and spreading globally.

Chrysler told employees worldwide – not just factory workers – to take a mandatory two-week vacation in July.

The Carlyle Group announced creditors planned to seize the assets of its mortgage-bond fund after it failed to meet more than $400 million in margin calls on mortgage-backed collateral that has plunged in value.

Gold rose above $1,000 an ounce for the first time as mounting credit-market losses spurred demand for bullion as a haven from the sagging dollar and equities. Silver and platinum also advanced as the dollar dropped below 100 yen for the first time since 1995 and to a record against the euro. Gold is up 37 percent since the Federal Reserve began cutting interest rates in September, sending the dollar tumbling.

U.S. home foreclosure filings jumped 60 percent and bank seizures more than doubled in February as rates on adjustable mortgages rose and property owners were unable to sell or refinance amid falling prices.

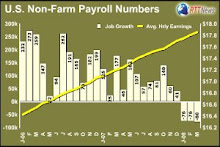

Retail sales in the U.S. unexpectedly fell in February, indicating that declines in payrolls and home values and a surge in energy costs have pushed the economy into a recession. Sales dropped 0.6 percent, led by auto dealers and restaurants, after a 0.4 percent gain in January, the Commerce Department said. Meanwhile, the Labor Department said jobless benefits rolls climbed to a 2 1/2-year high, and import prices soared 13.6 percent from a year ago, reflecting higher energy costs.

U.S. import prices rose by a less-than-expected 0.2 percent in February as petroleum prices dipped while export prices increased by a surprisingly strong 0.9 percent as food prices soared, a government report showed today.

Global writedowns linked to the U.S. sub-prime crisis could reach $285 billion, $20 billion more than expected earlier this year, credit ratings agency Standard & Poor's said in a report published today.

The Dow and Nasdaq indexes were up slightly after a morning plunge.

Meanwhile, in the March-April edition of Foreign Policy magazine, the chairman of RGE Monitor warns that central banks cannot save the U.S. or the world from the worsening recession. Slashing interest rates is not enough, writes Nouriel Roubini, a professor of economics at New York University's Stern School of Business.

"Central banks don't have as free a hand (as they had in 2001)," he writes. "They are constrained by higher levels of inflation."

He also cautions that stimulus packages, like the one passed by Congress and signed by President Bush, will have little beneficial impact on the stalling economy.

"The United States is facing a financial crisis that goes far beyond the subprime problem into areas of economic life that the Fed simply can't reach," says Roubini. "The problems the U.S. economy faces are no longer just about having enough cash on hand; they're about insolvency, and monetary policy is ill equipped to deal with such problems."

Roubini points out the sorry details all too evident in the day's news – led by millions of households on the brink of default on mortgages.

"When the economy falls further, corporate default rates will sharply rise, leading to greater losses," he writes. "There is also a 'shadow banking system,' made up of non-bank financial institutions that borrow cash or liquid investments in the near term but lend or invest in the long term in non-liquid forms. Take money market funds, for example, which can be redeemed with just one month's notice. Many of these funds are invested and locked into risky, long-term securities. This shadow banking system is therefore subject to greater risk because, unlike banks, they don't have access to the Fed's support as the lender of last resort, cutting them off from the help monetary policy can provide."

Roubini concludes it will "take years to resolve the problems that led to this crisis."

In fact, it's hard to consider solutions when the problems seem to grow worse each day – especially in the area of mortgage foreclosures.

"With declining prices, there is a pervasive problem of not being able to refinance or sell,'' Susan Wachter, professor of real estate at the University of Pennsylvania's Wharton School in Philadelphia, told Bloomberg News. "I'm very concerned. This is continuing to worsen. It tells us that we are not at a bottom.'''

About $460 billion of adjustable-rate mortgages are scheduled to reset this year and another $420 billion will rise in 2011, according to New York-based analysts at Citigroup Inc.

Homeowners faced higher payments as fourth-quarter home prices fell 8.9 percent, the biggest drop in 20 years as measured by the S&P/Case-Shiller home price index.

According to Rick Sharga, executive vice president of RealtyTrac, foreclosure filings are likely to be "explosive'' in May and June as more payments jump, after remaining at current levels this month and next. He said there may be between 750,000 and 1 million bank repossessions in 2008. '

February was the 26th consecutive month of year-on-year monthly foreclosure increases, Sharga told Bloomberg News.

Thursday, March 13, 2008

Subscribe to:

Post Comments (Atom)

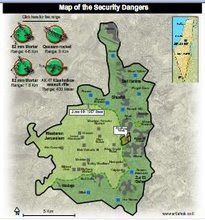

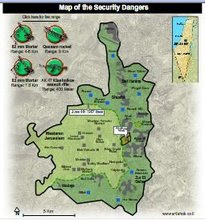

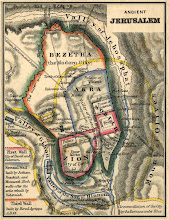

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment