Stocks lower on financial uncertainty

By Adam Shell

USA TODAY

March 17, 2008

http://www.usatoday.com/money/markets/2008-03-17-stocks-mon_N.htm?loc=interstitialskip

NEW YORK — Jittery investors dumped stocks when trading opened in the USA Monday, a sign that confidence in the financial system has taken a hit after Sunday's news that JPMorgan Chase (JPM) bought Bear Stearns, the nation's fifth-largest investment bank, at a fire sale price.

All major market indexes plunged, but then rebounded a bit. The Dow Jones industrial average even managed to turn positive briefly. About 10:30 a.m. ET, the Dow was down almost 0.2%, the Nasdaq composite and S&P 500 indexes were off about 1%.

FED STATEMENT: Text of Sunday's statement on credit and interest rates

PRESS RELEASE: Details of the Chase-Bear Stearns deal

PAULSON: Government will act to aid economy

At a White House meeting with his economic team, President Bush said Monday, "One thing is for certain: We're in challenging times, but another thing is for certain: We've taken strong and decisive action."

He said the Fed's actions over the weekend "shows the world that the United States is on top of the situation ... We'll obviously continue to monitor the situation and when need be, we'll act decisively."

JPMorgan said Sunday that it would acquire Bear Stearns for $236.2 million in a deal backed by the Federal Reserve. JPMorgan will pay $2 a share, though Bear Stearns closed at $30 a share Friday.

The sudden demise of Bear Stearns, fifth-biggest U.S. investment bank, has left investors shaken.

"There is a crisis of confidence," says Andy Brooks, trader at money management firm T. Rowe Price. "Investors are wondering, 'Does it mean other banks and brokerages are at risk?'"

How trading shapes up on Wall Street could offer clues as to whether the heavy selling that has rocked the stock market this year will worsen and mark a fresh leg down for stocks — or whether a selling climax occurs, paving the way for a market bottom and market recovery.

Says Brooks: "Is the selling a cathartic event, the kind that creates a big flush and helps form a bottom? I don't know."

Foreign markets reacted negatively to the news of Bear Stearns' demise.

Overseas, Japan's Nikkei stock average fell 3.71% overnight, while Hong Kong's Hang Seng index fell 5.18%. In afternoon trading, Britain's FTSE 100 fell 2.69%, Germany's DAX index dropped 3.65%, and France's CAC-40 lost 2.99%.

The dollar sank to a record low against the euro and hit a 12 1/2 year low against the yen, while gold prices surged to another record high.

Light, sweet crude dropped $3.49 to $106.72 per barrel on the New York Mercantile Exchange, after rising to nearly $112 a barrel in premarket trading.

In a note to clients early this morning, Jason Trennert, founder of Strategas Research Partners, offered some possible implications of the Bear implosion, which he described as "an old-fashioned run on the bank."

The crisis opens the door for more government intervention, Trennert says.

The lack of confidence in markets will likely mean that the Federal Reserve will have to cut short-term interest rates as much as 1 full percentage point when it meets tomorrow, Trennert said. He also told clients that while it "may be tempting to buy the strong hands in the financial sector, we would remain cautious on the sector."

Shares of the other major Wall Street firms fell in early trading.

Merrill Lynch economist David Rosenberg said a transition is underway from "crisis prevention to crisis management."

Rich Suttmeier, chief market strategist at RightSide.com, says he expects a "massive flight to quality" trade today as investors reduce risk in their portfolio.

"There is a lot of apprehension," he says.

A key to the market's recovery, he says, is a move by the Fed to try to determine what all the "toxic investments," such as securities tied to mortgage-backed securities and other exotic financial products are worth.

"An assessment of what this stuff is worth is necessary," says Suttmeier.

Says Michael Farr of investment firm Farr Miller & Washington: "There is a lot of tension. We have to wait and see what will happen in the financial sector."

Monday, March 17, 2008

Subscribe to:

Post Comments (Atom)

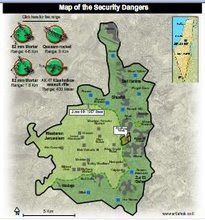

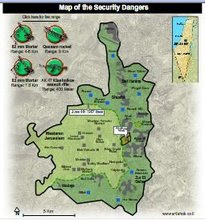

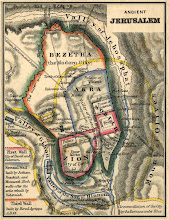

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment