Global markets reel after first-half carnage

By Michael Mackenzie in New York

Javier Blas in London

Andrew Wood in Hong Kong

Published: June 27, 2008

http://www.ft.com/cms/s/0/8d32f66a-4470-11dd-b151-0000779fd2ac.html?nclick_check=1

Global equities were on Friday heading for their worst first-half performance in 26 years after a week in which oil surged to a record and there were renewed worries about the health of the financial system and global growth.

A high of $142.99 a barrel for oil sparked a tumble in Asian markets and selling in Europe and New York. The Dow Jones Industrial Average on Friday closed just shy of 20 per cent below its record high set in October and is on cusp of entering an official bear market.

Fears of inflation and slower growth caused by higher energy costs are weighing on equities. Yet as stocks suffer, the surge in oil and other commodities during 2008 has the Reuters-Jefferies CRB spot index on track for its largest gain in 35 years. The index has risen 30.1 per cent since January, the largest increase since the 30.2 per cent gain in the first half of 1973.

Evidence of renewed financial stress as banks prepare to close out the second quarter and report earnings next month is also fanning fears.

On Friday the MSCI world equity index had fallen 11.7 per cent since the start of the year, its worst first-half run since a decline of 13.8 per cent during the first six months of 1982.

The S&P 500 closed below 1,300 this week and on Friday tested its mid-March closing low when the collapse of Bear Stearns briefly threatened to spark a systemic financial crisis. The index fell 3 per cent this week.

In Europe, the FTSE Eurofirst was 21 per cent lower for the year, its worst first-half performance since the index was configured in 1986.

The FTSE 100 has fallen 14.4 per cent in 2008, its worst start since a decline of 14.6 per cent in 1994. The S&P 500 has lost 12.5 per cent, its poorest first half since it fell 13.8 per cent in 2002.

Worries about the health of the US economy, a vital market for many of Asia’s export-led economies hammered regional equity markets on Friday.

In Japan, the Nikkei 225 Average fell more than 2 per cent to a two-month low. Shanghai shares plunged 5.2 per cent and the market is in danger of losing all of the gains made during last year’s eight-month rally of 141 per cent.

Saturday, June 28, 2008

Subscribe to:

Post Comments (Atom)

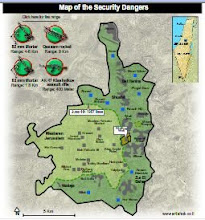

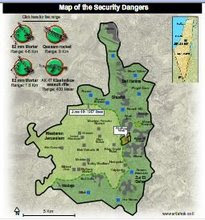

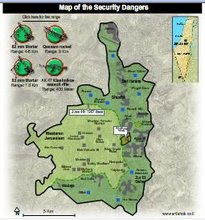

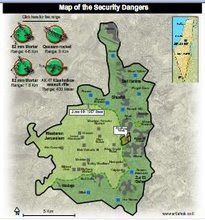

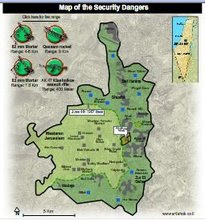

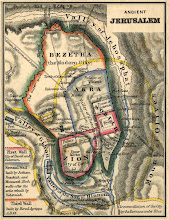

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment