Market drops 3 percent on profit jitters, oil record

By Kristina Cooke

June 26, 2008

http://news.yahoo.com/s/nm/20080626/bs_nm/markets_stocks_dc;_ylt=AlkEaW_1S_.YvLp0nEdurQRZ.3QA

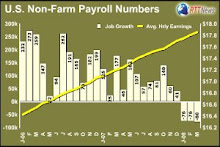

NEW YORK (Reuters) - Stocks plunged on Thursday, with the Dow sliding about 360 points to a 21-month low as oil hit a record and Wall Street powerhouse Goldman Sachs urged investors to sell bank and automaker shares, escalating concern about the outlook for profits.

Oil surged above $140 a barrel in New York trading, compounding fears that soaring inflation will hamper a global economy already on the ropes.

Investors found little to lift their spirits amid the barrage of harsh news, and the three major U.S. stock indexes fell 3 percent. All 30 stocks in the Dow ended in the red.

Technology shares were hammered after weak profit outlooks from BlackBerry maker Research in Motion (RIMM.O)(RIM.TO) and software maker Oracle Corp (ORCL.O). Disappointing U.S. earnings from Nike (NKE.N) further darkened the mood.

Financial stocks plummeted after Goldman Sachs forecast more write-downs at Citigroup (C.N) and Merrill Lynch & Co (MER.N).

General Motors' (GM.N) stock sank to its lowest level in 53 years, after Goldman warned that the big U.S. automaker could have to raise capital and cut dividends in a brutal slowdown for the auto industry.

"The price of oil is now at $140 and there is real concern that global growth is going to seriously slow down and that's hitting all sectors," said Eddie Bakker, managing director of equity sales and trading at Calyon Securities in New York.

The Dow Jones industrial average (.DJI) slid 358.41 points, or 3.03 percent, to 11,453.42, putting it within the grasp of a bear market.

The Standard & Poor's 500 Index (.SPX) tumbled 38.82 points, or 2.94 percent, to 1,283.16, while the Nasdaq Composite Index (.IXIC) dropped 79.89 points, or 3.33 percent, to close at 2,321.37. It was the Nasdaq's worst one-day percentage drop since January.

Citigroup's stock fell 6.3 percent to $17.67 after hitting a session low at $17.53, its lowest since October 1998. Merrill Lynch's stock dropped 6.8 percent to $33.05.

BlackBerry maker Research in Motion's U.S.-listed stock plummeted 13.3 percent to $123.46 on Nasdaq, a day after it forecast weaker-than-expected profit growth.

Shares of Oracle Corp (ORCL.O), the world's No. 3 software maker, fell 5 percent to $21.42 on Nasdaq, while Nike's shares plunged 9.8 percent to $59.50.

GM dropped 10.8 percent to close at $11.43 on the New York Stock Exchange, just off a session low at $11.21. The plunge dragged down the rest of the auto sector.

The price of oil surged after Libya said it was studying options to cut output in response to possible U.S. actions against producer countries. U.S. crude oil for August delivery settled at a record $139.64 a barrel, up $5.09, or 3.8 percent, after jumping to a record $140.05 a barrel.

Economic data also painted a gloomy picture. The government reported that a four-week average of new jobless claims, a measure of underlying labor trends, rose to its highest since October 2005 in the aftermath of Hurricane Katrina.

Sales of previously owned U.S. homes rose in May and the glut of homes for sale shrank, but prices were off sharply from a year ago, suggesting the housing sector remains a big weight on the economy.

U.S. gross domestic product, which measures total output of goods and services within U.S. borders, grew at a 1 percent annual pace in the first quarter, matching forecasts.

Trading was moderate on the New York Stock Exchange, with about 1.54 billion shares changing hands, below last year's estimated daily average of roughly 1.90 billion, while on Nasdaq, about 2.30 billion shares traded, above last year's daily average of 2.17 billion.

Declining stocks trounced advancing ones by a ratio of more than 5 to 1 on the NYSE and by 4 to 1 on Nasdaq.

Thursday, June 26, 2008

Subscribe to:

Post Comments (Atom)

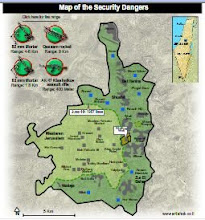

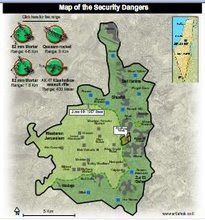

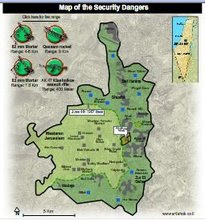

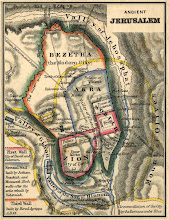

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment