In the eye of an economic storm

WorldNetDaily

Craig R. Smith

July 10, 2008

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=69224

This hurricane season will be quite different than seasons past. While most start with tracking tropical depressions that gain momentum and eventually develop into hurricanes graded on the Saffir-Simpson Scale, this season will be about subprime loan losses developing into a gale-force financial wind that may well destroy everything in it's path.

Like all hurricanes, this one will have three components: The front wall, the eye and the back wall.

The subprime mortgage mess was the front wall of the hurricane currently rocking our financial system. Once-great investment banks, like Bears Stearn, were destroyed overnight. America's largest home lender, Countrywide, was sold to Bank of America to avoid bankruptcy. Now the subprime mess may take down a commercial lender like Citigroup or B of A.

This is just the beginning of the devastation to come from this hurricane season.

Billions of losses continue to mount for lenders across the globe who ventured into the dark and nefarious world of subprime. More than a trillion dollars worth of homeowner equity has evaporated as thousand of homes went on the market in a wave of panic selling.

Trillions are being drained not only from Main Street but now Wall Street as values on the Dow continue to plummet. Many areas of the country have witnessed 20 to 40 percent drops in home values, and lenders and banks have seen their stock prices cut in half to two-thirds. Freddie Mac (Federal Home Loan Mortgage Corporation) has suffered a drop in stock prices from $35 to $10. Citigroup, the world's largest bank in 2006, is now the seventh largest, watching it's stock drop from $53 to $15 in the last 12 months alone.

Shareholders of Ambac, the guarantor of public finance and structured financial obligations, watched in horror as their stock plunged from $87 to $2. MBIA, another financial insurer, dropped from $69 a share to $4.

And the list goes on and on.

Now we are in the eye of the storm. There is relative calm right now, and, as in a hurricane, only a fool would leave the safety of shelter assuming the storm has passed. In my opinion, the worst is yet to come. The back wall of the hurricane is about to hit – and potentially with much more force than the front wall.

Soon the resets on the next series of subprime loans will come due. By March 2009, most, if not all the subprime loans created during the run up in real estate will be complete, and more foreclosures will add additional inventory to the already beleaguered housing market. Add to that trillions of dollars in credit card debt, consumer debt in the form of home equity loans, derivatives and commercial real estate loans and we have 150 mph financial winds that could rip a very fragile system completely free from it's mooring.

So as in any hurricane, one either runs for their life before the storm hits or battens down the hatches in the hopes of riding out the storm.

Soon our financial leaders like Fed Chairman Ben Bernanke and Treasury Secretary Henry Paulson will either have to prepare America for a lot more pain or employ all their resources to bail everyone out of the mess. From commercial banks to homeowners. Credit card users to common businesses. All will look to the Fed and the government for their financial salvation.

Given that we are in an election year, the Fed will not disappoint. It will run the printing press at full speed 24 hours a day, seven days a week to provide the cash necessary to save the system. It will have to choose between doing the right thing and political expediency.

Which will they choose? Will the government stop spending money? Will the Fed stand by and watch a commercial bank or a company like General Motors go bankrupt? I doubt it. They will make piles of freshly printed money to keep the spending orgy afloat.

The Fed has to turn the spigot on and do so fast. Inflation will run well above the current (ridiculous) official rate of 4 percent. Expect to see 8 to 12 percent inflation at minimum until the markets recover from the fresh injection of easy cash they get from the Fed. Creating inflation will ruin the life savings of the many people who did not prepare. We have seen it happen. Yet we ignore the lessons of history. This round of inflation will only put off the day of reckoning yet again, and this time we may not recover.

I hope I am wrong. Believe me when I say I take no pleasure in writing this type of assessment of the current conditions we face, but I can not change the facts. We have overindulged at the trough of debt. Government, business and individuals spent borrowed money like there was no tomorrow. But tomorrow has indeed arrived.

The Dow is down 21.3 percent this year so far. The S&P is down 20.5 percent. No matter how many times the cheerleaders on Wall Street hail each drop as a "buying opportunity," the market continues to deteriorate. Financial stocks have been decimated and may go much lower. Oil is exploding, along with all commodities as the cost of everything from gasoline to eggs continues to rise.

Europe and other parts of the world see the handwriting on the wall and have taken steps to protect against the inflation they see coming to America. The ECB raised rates last week while our Fed did not. The world will not allow the U.S. to export our inflation, so expect to see countries like Saudi Arabia to break their traditional peg to the U.S. dollar.

Gold is no longer a luxury; it's a necessity. Approximately 10-25 percent of every portfolio should have a gold hedge, in the form of coins physically held in the owner's possession, as it is now seen as a currency. The same role it played for years before Americans bought into a dollar that was nothing more than an IOU. The only people in the world who don't look at gold as money are central bankers. They cannot print gold out of thin air like they can paper currencies.

As anyone residing in hurricane country will tell you, preparation is essential to weathering the storm. It is time to put up the storm shutters and tie down anything that is loose. Americans must store up essential supplies and wait out the storm. It's better to be safe than sorry. After it passes, those who have prepared will be the only ones able to rebuild.

Thursday, July 10, 2008

Subscribe to:

Post Comments (Atom)

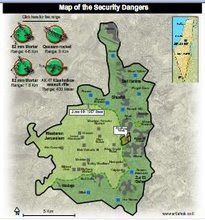

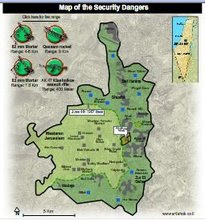

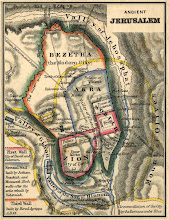

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment