U.S. Stocks Slump as Oil Surges; Dow Average Enters Bear Market

By Michael Patterson

http://www.bloomberg.com/apps/news?pid=20601087&sid=aF4fDOUXmP2k&refer=worldwide

July 2 (Bloomberg) -- U.S. stocks tumbled, sending the Dow Jones Industrial Average into a bear market, after oil rose to a record and steelmakers and coal producers retreated on concern the economic slump will worsen.

The Standard & Poor's 500 Index slid to its lowest since July 2006 as crude climbed above $144 a barrel, dimming the outlook for corporate profits. General Motors Corp., the biggest U.S. automaker, plunged to a 54-year low on Merrill Lynch & Co.'s warning that ``bankruptcy is not impossible.'' Nucor Corp. led the steepest decline in steel shares since 2002 as concern grew that the auto slump will cut demand and the government said metals orders decreased. Peabody Energy Co., the largest U.S. coal producer, slid as European prices fell the most since 2005.

``Investor sentiment is clearly miserable right now,'' said Wayne Wilbanks, who oversees about $1.2 billion as chief investment officer of Wilbanks Smith & Thomas Asset Management in Norfolk, Virginia. ``A lot of this misery among investors is starting to get priced into the indices.''

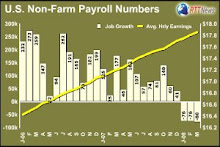

The Dow lost 166.75 points, or 1.5 percent, to 11,215.51. The S&P 500 plunged 23.38, or 1.8 percent, to 1,261.53, extending its 2008 loss to 14 percent. The Nasdaq Composite Index slid 53.51, or 2.3 percent, to 2,251.46. More than five stocks fell for each that rose on the New York Stock Exchange.

Technology and consumer shares also helped fuel the market's retreat after a private report showed a bigger-than-forecast drop in jobs last month. The 30-stock Dow average extended its retreat from the October record to more than the 20 percent, the first time since 2002 the gauge has closed below the threshold that signals a so-called bear market.

The S&P 500 has dropped 19.4 percent from its October record, while the Nasdaq has lost 21 percent from a nearly six year high on Oct. 31.

Bear Market

GM has led the Dow's retreat into a bear market, slumping 74 percent since the 30-stock gauge's record of 14,164.53 on Oct. 9. Dow components Citigroup Inc., American International Group Inc. and Bank of America Corp. each tumbled more than 50 percent over the same period as losses and writedowns at the world's biggest financial institutions topped $400 billion following the collapse of the U.S. mortgage market.

The Dow experienced 11 bear markets before this one since 1962, according to Westport, Connecticut-based research and money-management firm Birinyi Associates Inc. Declines averaged 29 percent and lasted 322 days, Birinyi data show. The biggest was a 45 percent drop during the 694-day period from January 1973 to December 1974.

GM sank $1.77, or 15 percent, to $9.98 today, the lowest since September 1954. The automaker was cut to ``underperform'' from ``buy'' at Merrill on bankruptcy concerns. GM, battered by the slowest U.S. automotive market in 15 years, may need to raise as much as $15 billion, Merrill said.

Crude Rally

Crude oil for August delivery rose 2 percent to $143.74 a barrel at the close of floor trading on the New York Mercantile Exchange after the Energy Department said supplies fell 1.98 million barrels to 299.8 million in the week ended June 27, the lowest since January. Inventories were forecast to rise 500,000 barrels, according to the median of nine estimates in a Bloomberg News survey. Futures touched a record $144.32 after the close of floor trading and have doubled in the past year.

Oil's jump helped drag down a measure of industrial shares in the S&P 500 by 3 percent to the lowest level since August 2006. FedEx Corp., the second-largest U.S. package-shipping company, dropped $1.67 to $74.70. Caterpillar Inc., the world's biggest maker of earthmoving equipment, declined $3.67 to $70.42.

``As long as oil is going higher every day, it's difficult to say that we will hit a bottom,'' Jack Ablin, who oversees $65 billion as chief investment officer at Harris Private Bank in Chicago, told Bloomberg Television.

Steel Slump

Nucor, the largest U.S.-based steel producer, slid $10.29, or 14 percent, to $61.94. U.S. Steel lost $21.95 to $153.40. The S&P 500 Steel Index tumbled 13 percent, the steepest drop since September 2002. The gauge is still up 2.7 percent this year.

Demand for primary metals dropped 2 percent in May, the Commerce Department said today. Bookings for iron and steel fell 1.7 percent. GM said yesterday it will cut North American production this quarter by about 12 percent after its June U.S. auto sales fell 18 percent.

Massey Energy, the fourth-biggest U.S. coal producer and the S&P 500's best performer this year, had the index's biggest fall today, losing $17.47, or 19 percent, to $74.87. Peabody, the largest, fell $7.99 to $77.90. Consol Energy Inc., the third- biggest, declined $16.38 to $95.57. A gauge of coal stocks in the S&P 500 dropped 13 percent today, trimming its 2008 advance to 28 percent.

Coal for delivery to Amsterdam, Rotterdam or Antwerp with settlement next year dropped $27.50, or 13 percent, to $190 a metric ton, according to ICAP Plc prices supplied to Bloomberg. That would be the biggest retreat compared with closing prices since March 2005. It jumped 36 percent from June 2 to yesterday's close.

`Hot Money'

``You're seeing some pretty smart investors who had ridden this cyclical commodity trade who are beginning to see the demand for this part of the market is going to decline,'' said Wilbanks. ``Those stocks have almost gone straight up, so you're going to have a correction and there's a lot of hot money in those stocks right now.''

Merrill Lynch & Co. lost $1.10 to $31.15 and Citigroup declined 29 cents to $16.84 after Oppenheimer & Co.'s Meredith Whitney reduced her second-quarter earnings estimates for the firms because of writedowns related to the bond-insurer downgrades and mortgage securities. The S&P 500 Financials Index lost 1.4 percent, extending its decline over the past year to 45 percent.

`Rockiest Road'

``It has certainly been about the rockiest road in decades for the financials,'' Shawn Kravetz, a portfolio manager at Esplanade Capital LLC in Boston, said in an interview on Bloomberg Radio. ``The question is what earnings will look like over the next few years. Until you can have a sense of that for some of these companies, they're just not companies we would choose to invest in.''

The S&P 500 Retailing Index of 29 chain stores and discounters lost 2.1 percent as the surge in oil and bigger-than- forecast decrease in jobs dragged down companies that rely on consumers' discretionary spending.

Home Depot Inc., the largest home-improvement chain, lost 69 cents to $22.52. Amazon.com Inc., the biggest Internet retailer, declined $2.18 to $71.44.

Technology shares in the S&P 500 fell 1.8 percent as a group. Apple Inc., maker of the iPhone, dropped $6.50 to $168.18. Research In Motion Ltd., producer of the rival Blackberry e-mail phone, retreated $7.07 to $116.20.

Jobs Concern

ADP Employer Services said the U.S. lost 79,000 jobs last month, almost four times the number forecast in a Bloomberg survey of economists. The report, which doesn't include government jobs, spurred concern that tomorrow's Labor Department report will depict a worsening employment market.

Payrolls probably shrank by 60,000 workers as employers cut jobs for a sixth consecutive month, according to the median estimate of economists surveyed by Bloomberg before the government jobs report.

Lehman's Rally

Lehman Brothers Holdings Inc. climbed $1.40 to $22.36. The fourth-largest U.S. securities firm is increasing the stock portion of employee pay this year, a person with knowledge of the matter said, as part of an effort to save cash following losses from the credit-market contraction.

Apollo Group Inc. surged $8.52, or 18 percent, to $54.78 for the top gain in the S&P 500. The largest for-profit provider of college degrees reported fiscal third-quarter earnings that topped analysts' estimates after expanding into high school education.

SanDisk Corp. climbed $1.10, or 6.2 percent, to $18.72 for the S&P 500's fourth-best advance. ThinkPanmure analysts advised buying shares of the world's largest maker of flash-memory cards, saying memory prices may ``stabilize'' on demand from Samsung Electronics Co. and Apple.

To contact the reporter on this story: Michael Patterson in New York at mpatterson10@bloomberg.net.

Thursday, July 3, 2008

Subscribe to:

Post Comments (Atom)

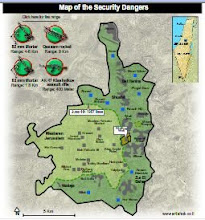

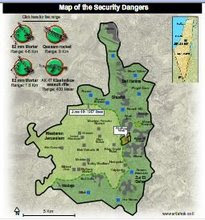

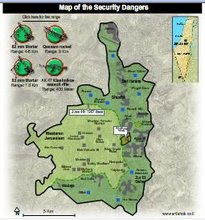

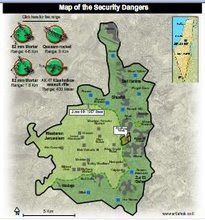

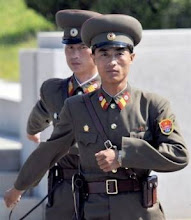

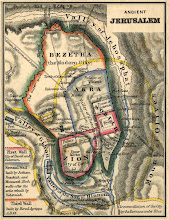

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment