World stocks at 21-month low as banks plunge

Tue Jul 8, 2008

By Natsuko Waki

http://www.reuters.com/article/newsOne/idUSHKG35069520080708

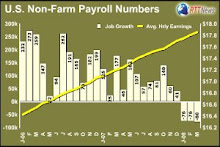

LONDON (Reuters) - Fresh credit fears swept global financial markets on Tuesday, pushing world stocks to their lowest levels since October 2006 as concerns intensified that the financial sector would have to raise more capital.

Banks tumbled across the board after a Lehman Brothers report said a pending accounting change could force Fannie Mae and Freddie Mac to raise an $46 billion and $29 billion respectively at a difficult time, knocking their shares to near 16-year lows on Monday.

In Britain, shares in troubled mortgage bank Bradford & Bingley fell 20 percent to record lows, below the price of its planned rights issue, due to concerns over its future.

Fresh worries over the financial sector dealt a blow to risky assets, which have been already reeling from fears about rising inflation due to high energy costs and slowing growth.

"The crisis in the financial system, given banks are the lubricant for the economy, points to continued tight credit," said Jonathan Lawlor, head of European research at Fox-Pitt, Kelton.

"So we have a loop where tight credit leads to slower economic growth, which leads to higher losses for the financial system, which leads to capital constraints for the banks."

MSCI main world equity index fell as low as 341.35, down 1 percent, hitting its lowest since October 2006.

The index is down 20 percent from its all-time peak set in November last year, plunging into bear market territory.

Tuesday, July 8, 2008

Subscribe to:

Post Comments (Atom)

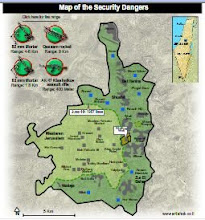

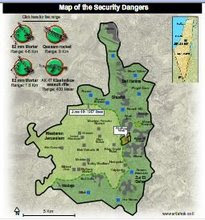

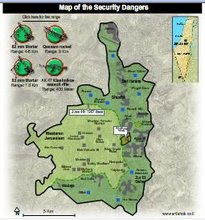

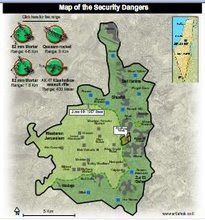

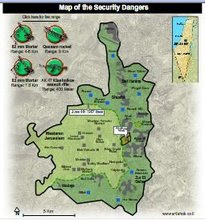

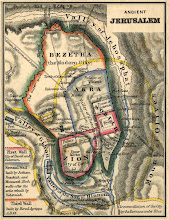

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment