Are we seeing the hook forming?

And thou shalt say, I will go up to the land of unwalled villages; I will go to them that are at rest, that dwell safely, all of them dwelling without walls, and having neither bars nor gates,

To take a spoil, and to take a prey; to turn thine hand upon the desolate places that are now inhabited, and upon the people that are gathered out of the nations, which have gotten cattle and goods, that dwell in the midst of the land. (Ezekiel 38:11,12)

The rouble has tumbled, the stock market has crashed, and investors have pulled $25bn

By Ailish O'Hora

Saturday August 30 2008

http://www.independent.ie/business/world/the-rouble-has-tumbled-the-stock-market-has-crashed-and-investors-have-pulled-25bn-1466132.html

Moscow caught in a bear hug

Moscow stock markets dipped to their lowest levels since 2006 as the effects of Russia's first foreign war as a capitalist country resulted in the loss of billions of dollars in paper value.

The rouble also posted its biggest monthly decline against its dollar-euro basket as international tension over the war in Georgia prompted investors to reduce holdings of Russian assets.

The currency, which the central bank keeps within a trading band against the basket to protect the competitiveness of Russian exports, tumbled 1.7pc in August, the most since the basket was introduced in 2005.

The war with Georgia, and the US and Europe's condemnation of it, caused investors to pull about $25bn from Russia, according to BNP Paribas SA, France's largest bank. This figure differs significantly from the $7bn estimate from the Russian government.

"It's been a bad month in terms of political effects and more and more people are seeing Russia negatively now,'' said Ulrich Leuchtmann, an emerging-markets currency strategist in Frankfurt for Commerzbank AG, which rates itself as one of the top 10 rouble traders in the world.

"It will take much longer for the rouble to go back to its pre-crisis patterns.''

The discomfort between East and West deepened further yesterday when Russia said it may suspend some "uncomfortable'' accords agreed to in talks to join the World Trade Organisation (WTO), trade negotiator Maxim Medvedkov said.

These don't include plans to raise domestic gas or rail prices, he said.

Russia, the biggest economy outside the WTO, finished talks with all individual WTO members except Georgia and Ukraine and was negotiating a final agreement with the trade arbiter as a whole when military conflict with Georgia broke out.

US Deputy Assistant Secretary of State Matthew Bryza said that "WTO members will respond'' to the actions in Georgia.

But before the WTO news emerged, foreign investors were already spooked; this was deepened by grim warnings from Western leaders of unspecified or economic retaliation for the Georgia move.

The RTS stock market fell 6.1pc on Tuesday after President Dmitri Medvedev recognised two separatist states in Georgia.

The market later recovered somewhat, but investors remained glum about its prospects.

"The market perception is extremely negative," said James R Fenkner, chairman of Red Star Management, a Moscow hedge fund. "They're going to have to do some serious things to change it."

While the picture looks grim, it's not as if Russia is about to go broke as it did in the financial collapse of 1998.

It is likely that any Western effort to punish Russia will be softened by the surging demand for the country's deep oil and gas resources.

In addition, economic indicators are strong. Russia's economy expanded 7.9pc in the first seven months of the year, the Russian economy ministry said on Thursday in a first estimate of growth for the period. Growth was the same as a year earlier, the ministry reported.

Gross domestic product grew 6.9pc in July, less than the 8.7pc gain in the same month last year, it said.

"High growth rates were supported by a favourable global situation for exports, steady consumer demand, construction growth and fairly high investment activity,'' the Moscow-based ministry said.

And it remains to be seen whether stock slumps will influence policy.

Economic pressure can cut both ways. Many analysts have questioned whether Western European economies that depend heavily on Russian oil and gas will support penalties severe enough to provoke retaliation from the Kremlin.

Even the US could have something to lose from confronting the bear. Russia's cental bank and sovereign wealth funds had about $100bn in mortgage-backed securities from Freddie Mae and Fannie Mac.

While Russia has reduced its holding since then, it has not dumped its entire portfolio.

It is ironic that because of Russia's more recent economic success there are now penalties with a lot more sting that could be applied by the Western world if the former communist state's stance on Georgia doesn't soften.

Possible measures could include barring Russia from WTO membership and expelling it from the "Group of Eight" industrialised countries.

And what would stick in the craw of the oligarchy even more would be the withholding of visas and freezing of offshore bank accounts of Russian political leaders.

Many of the top officials in Russian government also sit on the board of directors of state companies.

Mr Medvedev, for example, was chairman of the gas monopoly Gazprom until his inauguration in May.

"Such connections never existed in the cold war," said Irina Yashina, a researcher at the Institute for the Economy in Transition.

Despite state control, many of these companies are also striving to globalise their businesses as an outlet for Russia's commodity wealth. (Additional reporting Bloomberg)

- Ailish O'Hora

Saturday, August 30, 2008

Subscribe to:

Post Comments (Atom)

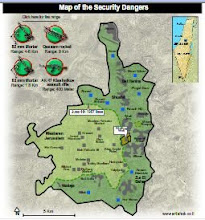

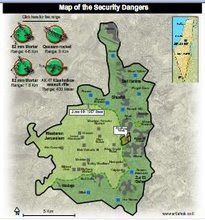

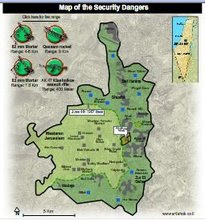

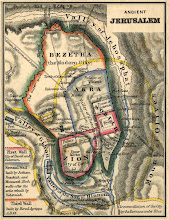

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment