Gog/MaGog Watch

Russia acknowledges financial crisis has hit hard

By Michael Stott - Analysis

MOSCOW (Reuters) -

November 21, 2008

http://ca.reuters.com/article/reutersEdge/idUSTRE4AK4L620081121?pageNumber=2&virtualBrandChannel=0

Russia had convinced itself -- and the outside world -- that its huge oil wealth and vast foreign exchange reserves made it much less vulnerable than others to the global financial crisis.

But after weeks of virtual silence by state media about the effects the crisis has had on Russia, President Dmitry Medvedev has suddenly acknowledged the extent of the damage.

"In all likelihood, the crisis is going to spread. Here we have to face reality," he said on Tuesday.

Top bankers and businessmen say Medvedev's words amounted to an official acknowledgement of what they have sensed in recent weeks -- a sudden, dramatic slowdown of the economy as credit dried up, sales slumped and factories laid off staff.

"We had thought that Russia would be far less badly hurt by the crisis than other major economies," said one leading Russian banker, speaking on condition of anonymity.

"Now it is clear that Russia will be much worse affected by the crisis than other major economies and will be affected for much longer.

"The government is still officially predicting growth of 6.7 percent next year but the World Bank this week halved its growth forecast for Russia to 3 percent and many businessmen and bankers say privately growth will be at best zero.

Underlining the fresh sense of urgency felt in the government, Prime Minister Vladimir Putin on Thursday announced a $20-billion package of tax cuts and extra spending to help pensioners, companies and the unemployed. This was on top of $200 billion of financial aid already pledged by the Kremlin.

REASONS FOR THE GLOOM

The reasons for the sudden gloom, bankers and analysts say, are four-fold:--

economists had highlighted negligible government debt but ignored the fact that Russian oligarchs built up huge foreign debts by buying assets at home and abroad whose stock market value has now collapsed. Since the assets are in many cases key national companies, the Kremlin has to bail the oligarchs out--

the country's once-mighty gold and foreign exchange reserves, which peaked at $597 billion in August, have slumped to $453 billion and are dwindling at a rate of $22 billion a week--

prices of Russia's main exports, energy and metals, have collapsed in recent weeks to levels nobody anticipated. Russia's benchmark Urals crude was trading at $44 on Friday, less than half the $95 level anticipated in next year's budget--

many small and medium-sized Russian companies are poorly capitalized and relied on easy bank credit; they have found themselves too short of cash to continue normal operations

The Russia country manager of one leading European consumer sector company, speaking anonymously because he is not authorized to talk to the media, said his sales boomed through the year until: "In October, they just fell off a cliff."

"Consumers hadn't stopped buying," he said. "But our wholesalers and distributors ran out of money and stopped placing orders."

ROUBLE'S FATE IS SIGNIFICANT

In a country where few hold shares but most watch the price of dollars, the fate of the rouble has of huge significance.

Ordinary Russians, who have suspected for some weeks that the real economic picture may be less rosy than the official one painted by state-controlled television, have been quietly withdrawing large amounts of roubles from banks to buy dollars.

The central bank announced on Wednesday it had spent $57.5 billion of reserves in the past two months selling dollars to prop up the rouble and analysts said that over the same period savers had withdrawn a quarter of all their deposits.

After weeks of insisting that the rouble would not be devalued, the government now faces an impossible choice: burn up the country's remaining vital foreign exchange reserves in what many regard as a hopeless battle to defend the rouble, or let the currency go and face a collapse of public confidence.

"It would probably be better from a macro-economic point of view to allow the rouble to float freely," said one senior Russian government official, speaking on condition of anonymity.

"But if we do, there is a risk that it will overshoot, fall as much as 50 percent and trigger a run on banks."

COMPANIES' WOES MOUNT

Problems continue to mount for key Russian companies. Used to years of steadily rising sales and often heavily in debt, they are facing a sudden collapse in demand.

In a latest sign of trouble, electricity generators have seen a sudden rise in unpaid bills from corporate customers. For the past three weeks, 13 percent of industrial users have not paid their bills, compared to about 8 percent before the onset of the crisis, industry regulator Dmitry Ponomaryov said on Wednesday.

The latest Russian giant to hit the buffers is potash miner Uralkali, whose products are used to make fertilizer.

Its shares, already weak after the government reopened an investigation into a mine accident, crashed after it announced plans to slash production. The stock is now 96 percent down on its June peak, on a par with Russia's distressed property developers who are sitting on thousands of unsold flats.

As layoffs mount, the economic pain is posing a growing threat to the dual leadership of Medvedev and Putin.

An opinion poll published this week by the independent Levada Center showed the proportion of Russians who think the government is doing a good job handling the crisis had almost halved from 13 percent in October to 7 percent in November.

Those saying it is performing badly rose from 27 percent to 33 percent.

In this environment, even the better-placed of the country's famed billionaire oligarchs are feeling the heat.

One of Russia's five richest men, speaking on condition of anonymity, said many businessmen in Russia simply wanted "to be alive, the longer the better."

"This crisis is hitting everybody, big business and small business," he said. "...but Russians are really fighters. They will fight to the end."

Saturday, November 22, 2008

Subscribe to:

Post Comments (Atom)

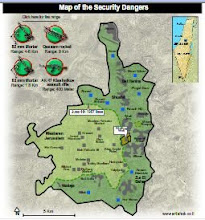

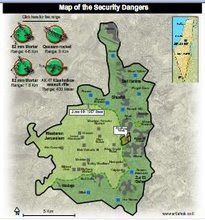

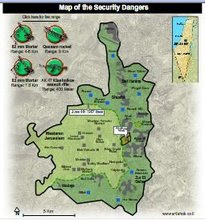

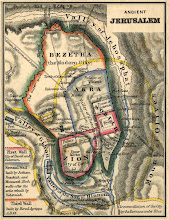

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

1 comment:

I think it was obvious, that Russia would get deep inside the crisis. In world economic Forum's survey they were ranked around #100 (out of some 140 countries) in bank soundness. And if we take into consideration their only source of income and economic power - oil - has returned back two years in prices, no wander Russia can expect severe problems...

Take care

Jill

Post a Comment