Drop in consumer prices is most since 1932

Core CPI flat in the month as energy prices plunge

By Robert Schroeder, MarketWatch

Dec. 16, 2008

Comments: 1300

http://www.marketwatch.com/news/story/drop-consumer-prices-most-since/story.aspx?guid=%7B45513693-102D-4A67-8859-C73778BF4777%7D&dist=msr_19#comments

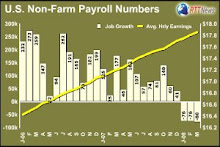

WASHINGTON (MarketWatch) -- U.S. consumer prices fell in November at the fastest rate since 1932, the darkest days of the Great Depression, the Labor Department reported Tuesday, as prices for energy, commodities and airline fares plunged across the country.

The U.S. consumer price index fell by a seasonally adjusted 1.7%, the department reported, the biggest drop since the government began adjusting the CPI for seasonal factors in 1947.

But on a non-seasonally adjusted basis, the CPI fell by 1.9%, the biggest decline since January 1932, at the nadir of the Great Depression.

"This is scary stuff," said Mike Schenk, an economist for Credit Union National Association. "We are teetering on the brink of a massive downward spiral. Deflation is a threat."

The seasonally adjusted core CPI was flat in November. Read the report.

Economists surveyed by MarketWatch were expecting the CPI to fall by 1.4%. They forecast that the core CPI would rise by 0.1%. See Economic Calendar.

Energy prices declined by a seasonally adjusted 17%, the most since February 1957. Gasoline prices plunged by 29.5% in November, the most since the government began keeping records in February 1967. Fuel oil prices dropped by 7.2%. Commodities prices declined by 4.1% in November.

The CPI data is one of the last pieces of the economic puzzle that the Federal Reserve will have to mull before its announcement about interest rates later Tuesday. The policy-making Federal Open Market Committee is almost universally expected to cut its target for overnight interest rates to 0.5% from 1%. See full story.

U.S. stock indexes rose after the price data and data about housing starts were released Tuesday. See Market Snapshot.

Over the past year, overall consumer prices have risen by 1.1%, down from their peak of 5.6% in July. Core prices have risen by 2% in the last 12 months.

Medical, food, clothing costs rise

Prices for certain goods rose in November, even as the overall number fell. Medical care prices, for example, climbed by 0.2%. They are up 2.7% in the past year. Also, food prices rose by 0.2% in November.

The cost of owning a house, meanwhile, rose 0.3% in November.

Falling transportation prices contributed to the overall decline. Those prices dropped 9.8% in November, the most in 61 years. They are down 8.9% over the past year.

The Labor Department also reported Tuesday that real average weekly earnings rose by 2.3% from October to November.

Within transportation, new vehicle prices fell 0.6%. Airline fares, meanwhile, dropped 4%.

In a separate report on Tuesday, the Commerce Department said that housing starts fell by a whopping 18.9% to a seasonally adjusted annual rate of 625,000, the lowest since the department began keeping records in 1959. See full story.

Wednesday, December 17, 2008

Subscribe to:

Post Comments (Atom)

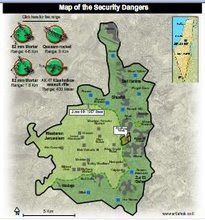

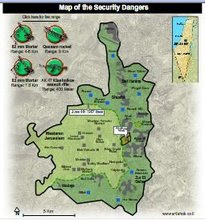

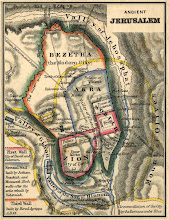

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment