Gog/MaGog Watch:

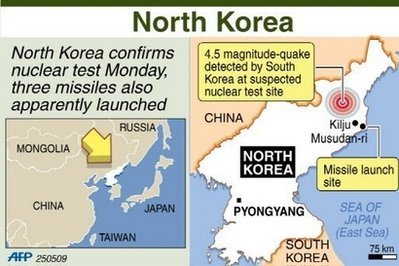

This is HUGE, BREAKING news! This could very well turn the ME upside down and cause Russia/Iran/Arabs (Ezekiel 38,39) to come down and receive their just rewards upon the mountains of Israel!

Latter Day Prophecy:

And of Asher he said, Let Asher be blessed with children; let him be acceptable to his brethren, and let him dip his foot in oil. (Deuteronomy 33:24)

Huge gas reserves discovered off Haifa

By JPOST.COM STAFF

18 January, 2009

http://www.jpost.com/servlet/Satellite?cid=1232265973374&pagename=JPost%2FJPArticle%2FShowFull

Three massive gas reservoirs have been discovered 80 kilometers off the Haifa coast, at the Tamar prospect, Noble Energy Inc. announced on Sunday.

The Tamar-1 well, located in approximately 5,500 feet of water, was drilled to a total depth of 16,076 feet. The thickness and quality of the reservoirs found were greater than anticipated at the location.

Charles D. Davidson, Noble Energy's chairman, president and CEO, said in an announcement that his company was "extremely excited by the results. This is one of the most significant prospects that we have ever tested and appears to be the largest discovery in the company's history."

Speaking on Army Radio Sunday morning, an exhilarated Yitzhak Tshuva, owner of the Delek Group Ltd, one of the owners of the well, called the discovery "one of the biggest in the world," promising that the find would present a historic land mark in the economic independence of Israel.

"I have no doubt that this is a holiday for the State of Israel. We will no longer be dependent [on foreign sources] for our gas, and will even export. We are dealing with inconceivably huge quantities; Israel now has a solution for the future generations," Tshuva added.

An ecstatic Infrastructures Minister Binyamin Ben-Eliezer said before the weekly cabinet meeting that the discovery was a "historic" one and could "change the face of Israeli industry."

In a statement released following the discovery, the Meimad-Green Movement party also praised the "historic discovery," and called to put plans to erect the coal-fired power plant in Ashkelon on hold.

"Until now, the central argument in favor of building the coal plant was that strategically, we cannot depend on clean natural gas, since its reservoirs are located in hostile countries," said Meimad chairman Rabbi Michael Melchior in the statement.

"Now, with the discovery of the huge reservoirs, the plans to construct the coal plant should be shelved, as it will cause severe health damage to the region's residents," said Melchior.

"Instead, we should build a plant powered by natural gas instead, Israeli and [environmentally friendly], which will have minimal health repercussions and aid Israel's economy," he added.

Production testing at Tamar will be performed after the well is completed. Noble Energy and its partners may keep the rig to drill up to two additional wells in the basin. Pending positive test results, one well could be an appraisal at Tamar.

Noble Energy operates the well with a 36 percent working interest. Other interest owners in the well are Israeli companies Isramco Negev 2, Delek Drilling, Avner Oil Exploration and Dor Gas Exploration.

Following the announcement of the discover, shares of Delek Drilling jumped up 80%, while shares of Isramco Negev 2 skyrocketed by an unprecedented 120 percent. The rest of the Tel Aviv stock market also saw huge gains, with the TA-Index 100 climbing nearly 4 percent.

Russians hoard cash as fear of crisis takes hold

Heather Stewart and Kathryn Hopkins

The ObserverSunday

18 January 2009

http://www.guardian.co.uk/business/2009/jan/18/russians-hoard-cash

Muscovites are hoarding thousands of dollars in safety deposit boxes, as fears intensify that Russia is teetering on the brink of a full-blown economic crisis, after the government devalued the rouble five times in six days.

World oil prices have plunged from almost $150 (£102) a barrel to below $35, pushing the country to the brink of recession. "Russia is a volatile economy at the best of times: it's heavily dependent on commodity prices - on oil and gas," said Nigel Rendell, senior emerging markets analyst at RBC capital markets.

As the public frets about a repeat of the 1998 financial crisis, when the government defaulted on its debts, sending shockwaves through the world financial system, banks are reporting a surge in use of safety deposit boxes in the capital.

"Russians have a massive distrust of high finance even at the best of times," said Neil Shearing, of consultancy Capital Economics.

"At the first sign of trouble, they pull their money out and stick it under the bed."

Even in 2004, the OECD estimated that up to $80bn, most of it probably in dollar notes, was circulating outside the official banking system.

"The memories of 1998 loom large, and the rouble is taken as a bellwether of the health of the economy," Shearing said. "They're essentially trying devaluation by stealth, so that no one notices."

The currency has shed 7% of its value in just five days, ending the week at 37.32 versus a euro-dollar basket. It has lost a fifth of its value since August, and Russian stock markets have lost 70% of their value since May.

Moscow has blown over a quarter of its foreign currency reserves over the last five months in a desperate bid to ensure that depreciation is gradual. Dealers estimate the central bank spent $26bn on interventions this week alone.

Rendell, of RBC, added that a number of small Russian banks have made very risky bets on the country's property bubble, and may have to be bailed out by the government in the coming months. "Russia has over a thousand banks, which is probably about 950 too many," he said.

Former Soviet leader Mikhail Gorbachev yesterday joined a chorus of influential Russians criticising the handling of the economic crisis. "Resources are directed not so much at protecting the interests of a majority of citizens as at saving the assets and property of a narrow circle of influential businessmen," said their letter, published in the Vedomosti newspaper. Oligarch Alexander Lebedev, who is buying the Evening Standard, was also a signatory.

The crisis echoes the fate of credit crunched states across central Europe. Latvia and Bulgaria have seen street protests over the economy in the past week, while Turkey is in talks with the IMF.

Sunday, January 18, 2009

Subscribe to:

Post Comments (Atom)

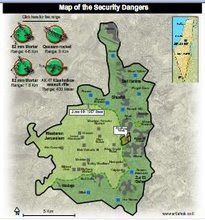

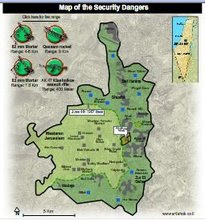

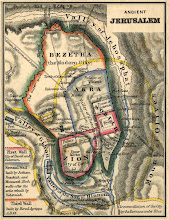

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment