Mark of the Beast Watch:

And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads:

And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.

Here is wisdom. Let him that hath understanding count the number of the beast: for it is the number of a man; and his number is Six hundred threescore and six. (Revelation 13:16-18)

...and the dragon gave him his power, and his seat, and great authority. (Revelation 13:2)

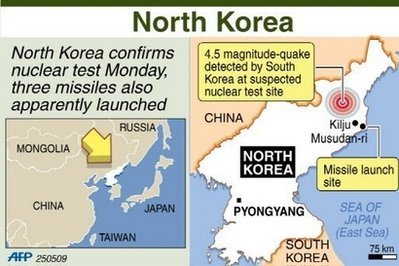

China Repeats Call For New Global Reserve Currency

June 26, 2009

http://www.dailymarkets.com/forex/2009/06/26/china-repeats-call-for-new-global-reserve-currency/

(RTTNews) - Friday, China reiterated its call for a new global reserve currency to replace the U.S. dollar, triggering a fall in the greenback in the currency markets.

In its Financial Stability Review for 2008, the People’s Bank of China said there is a need to create an international reserve currency with a stable value in the long term to avoid the shortcomings of sovereign currencies for maintaining reserves.

The Chinese central bank said it would push for the reform of international currency system for laying a solid foundation for global financial stability. Further, the PBoC called for reduced dependence on the existing reserve currencies dominated by the U.S. dollar, saying that excessive reliance on them have added to the extent of risks and crises.

This is not the first time in the recent past that the Chinese central bank has made such a remark. China holds the world’s largest currency reserves, which is just short of $2 trillion. Much of these reserves are held in the U.S. dollar.

Chinese authorities including Premier Wen Jiabao has been voicing concerns about the value of the dollar as the U.S. government battles its way out of recession. Excessive emphasis on the dollar as a reserve currency is something that does not go down well with China. Speculation is rife that China will diversify its currency holdings.

In an essay published late March just ahead of the G20 summit in London, the PBoC chief Zhou Xiaochuan repeated his call for a new global reserve currency managed by the International Monetary Fund. In a veiled reference to the U.S. dollar, Zhou insisted that an international reserve currency disconnected from individual nations would be able to remain stable in the long run, thus removing the inherent deficiencies caused by using credit-based national currencies.

Repeating Zhou’s proposal, the central bank report said the Special Drawing Rights or SDRs, which is the IMF’s unit of account, must be given a larger role to play. The IMF should manage part of its members’ reserves, the report adds. Further, the central bank called for close monitoring of the countries issuing the main reserve currencies.

The IMF created the SDR, an international reserve asset, in 1969 to supplement the existing official reserves of member countries. Member countries’ SDR holdings are in proportion to their IMF quotas. The value of the SDR is determined based on a basket of key international currencies. The SDR has only limited use as a reserve asset today, and its main function is to serve as the unit of account of the IMF.

The dollar dropped to a 2-day low of 95.19 against the Japanese yen, 1.6537 against the pound, 1.0833 against the Swiss franc and 1.411 against the euro just before commencing the New York session on Friday.

Friday, June 26, 2009

Subscribe to:

Post Comments (Atom)

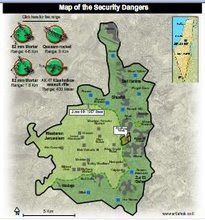

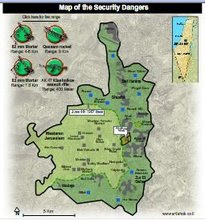

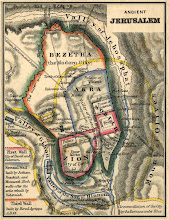

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment