Global enforcement body may be needed for banking sector - UK regulator

Posted by: Reuters Staff

By Huw Jones

http://blogs.reuters.com/financial-regulatory-forum/2009/10/16/eu-shelves-plan-to-unveil-disputed-bank-reform-for-now/

LONDON, Oct 14 (Reuters) - A global body with legal powers may be needed over time to enforce the world’s new financial rules, Britain’s Financial Services Authority (FSA) said on Wednesday.

The FSA’s newly appointed and first director of international affairs, Verena Ross, said the Financial Stability Board (FSB) was key to ensuring all gaps in regulation between securities, insurance and banking sectors were plugged.

Formerly known as the Financial Stability Forum, the FSB was expanded in April to include central bankers and finance ministry and regulatory officials from all Group of 20 (G20) countries.

The G20 has asked the body, chaired by Bank of Italy Governor Mario Draghi, to coordinate global efforts to introduce new financial rules in light of the sector’s worst crisis in 70 years.

“I would advocate to make sure the FSB have a strong secretariat to support their work,” Ross told a City and Financial Conference.

“The role of the FSB is crucial. We will need to make sure it is able to play its role forcefully… Success depends on real progress over the next six to 12 months,” she said.

But the board has no legal teeth and there are “real questions” about whether the world can continue with such informal arrangements in the longer term, Ross said.

There may be a case for exploring the need for a more formal global regulatory framework, such as a body with legal powers of enforcement like the World Trade Organisation, Ross added.

“Any move in that long-term direction would have the FSB very firmly at the centre of that global regulatory architecture,” Ross said.

2nd Article:

IMF Role in Governance of Sovereign Nations

Wednesday, 14 October 2009

National governments need to make way for international authorities to play a greater role in governance, particularly when it comes to finance and trade, says Kenneth Rogoff, a Harvard University professor and former chief economist at the International Monetary Fund.

"We probably need to strike a different balance between roles for national authorities, with international authorities taking more of a role," Prof. Rogoff said in an interview with the Financial Post at a recent governance conference held at the Centre for International Governance Innovation in Kitchener-Waterloo, Ont.

He said the financial sector was a prime example where global governance was needed, with the inadequacies of the present system highlighted by the financial crisis.

"I agree that we should have a global financial regulator," he said. "My main reason is that I think a financial regulator needs to be insulated from political pressures and it is very hard to do that with a domestic financial regulator."

Entire article: http://realfijinews.xanga.com/714458403/imf-role-in-governance-of-sovereign-nations/

Friday, October 16, 2009

Subscribe to:

Post Comments (Atom)

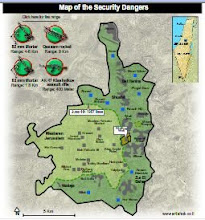

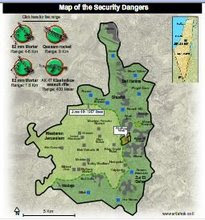

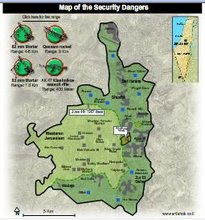

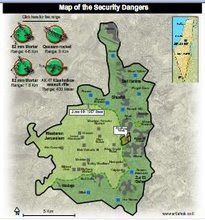

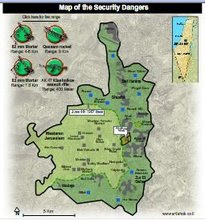

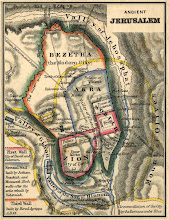

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment