Paulson shoots down Fannie, Freddie bailout

By Mark Felsenthal and Alister Bull

July 11, 2008

http://news.yahoo.com/s/nm/20080711/bs_nm/fanniemae_freddiemac_dc

WASHINGTON (Reuters) - Fear spread on Friday that the U.S. housing crisis would drag down the nation's major mortgage finance agencies and the government offered no hint that it would swiftly step in to help.

Amid worries that Fannie Mae (FNM.N) and Freddie Mac (FRE.N) might run short of capital, placing the fragile U.S. economy at even greater risk, Treasury Secretary Henry Paulson said the primary focus was supporting them "in their current form as they carry out their important mission."

The reference to keeping Fannie Mae and Freddie Mac in their current form was a signal that the government wanted to see the firms survive as congressionally chartered but privately held companies and was not on the verge of nationalizing them.

That came as a disappointment to many on Wall Street.

"While Paulson is making supportive comments to the GSEs, there was no suggestion of any imminent bailout -- nor enough specifics to the support they would give," said Bret Barker, portfolio manager with Metropolitan West Asset Management in Los Angeles. "The markets were looking for more from Paulson."

Concern about Fannie and Freddie grew significantly after The New York Times said the administration was considering a plan to put the companies, thought to have implicit government backing, into a conservatorship if their problems worsen, citing people briefed about the plan.

In late-morning trading, Fannie shares dropped 26 percent to $9.72, while Freddie tumbled 29 percent to $5.68. Both have lost close to 90 percent of their value since August. The companies' bonds posted gains.

Fannie and Freddie own or guarantee $5 trillion of debt, close to half of all U.S. mortgages. They have been hit hard by the nation's housing crisis, seeing borrowing costs rise and suffering billions of dollars of losses as many investors lose confidence they can raise sufficient capital to stay afloat.

Were Fannie and Freddie unable to borrow or find it too costly to borrow, they would not be able to buy mortgages from lenders. This would make it far more difficult, and perhaps impossible, for people to obtain home loans, which could cause the housing market to grind to a halt.

Investors view Fannie and Freddie as the last bastions of support for a U.S. housing market in its worst downturn since the Great Depression.

Putting Fannie and Freddie into conservatorship could wipe out shareholders, and obligate taxpayers to cover losses on home loans Fannie and Freddie own or guarantee.

A spokesman for Freddie Mac declined to comment. Fannie Mae could not be reached for comment.

Friday, July 11, 2008

Subscribe to:

Post Comments (Atom)

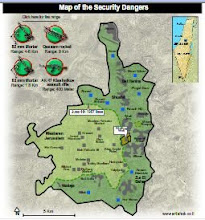

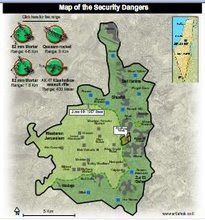

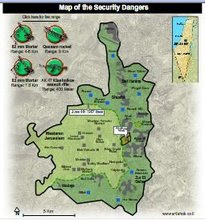

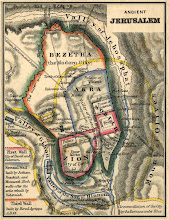

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment