U.S. seizes IndyMac as financial troubles spread

Fri Jul 11, 2008

By John Poirier and Rachelle Younglai

WASHINGTON (Reuters) - U.S. banking regulators swooped in to seize mortgage lender IndyMac Bancorp Inc on Friday after withdrawals by panicked depositors led to the third-largest banking failure in U.S. history.

California-based IndyMac, which specialized in a type of mortgage that often required minimal documents from borrowers, became the fifth U.S. bank to fail this year as a housing bust and credit crunch strain financial institutions.

The federal takeover of IndyMac capped a tumultuous day for U.S. markets that saw stocks slide on a surging oil price and renewed fears about the stability of the top two home financing providers, Fannie Mae and Freddie Mac.

IndyMac will reopen fully on Monday as IndyMac Federal Bank under Federal Deposit Insurance Corp supervision, but tensions ran high as customers at a branch at its Los Angeles-area headquarters read a notice in the window saying it was closed.

At another branch down the road, a man who said he had more than $200,000 in an account -- twice what is normally FDIC guaranteed -- argued with a security guard who was closing up.

The FDIC, which will seek a buyer for IndyMac, estimated the cost of the bank's failure to its $53 billion insurance fund at between $4 billion and $8 billion.

"IndyMac is a company that was pretty much 100 percent invested in mortgage assets, and we're in a bad mortgage market, and it had no capital. It's not complicated," said Adam Compton, co-head of global financial stock research at RCM in San Francisco, which manages about $150 billion.

IndyMac joins top bank failures headed by the 1984 collapse of Continental Illinois National Bank & Trust Co.

For the rest of the article:

http://www.reuters.com/article/gc06/idUSWA000014120080712

Saturday, July 12, 2008

Subscribe to:

Post Comments (Atom)

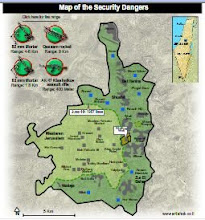

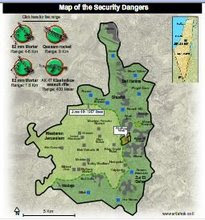

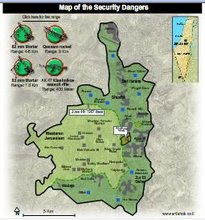

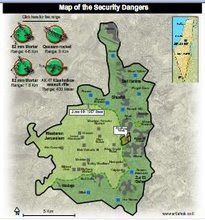

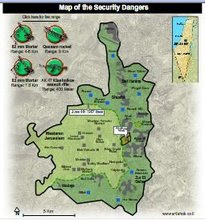

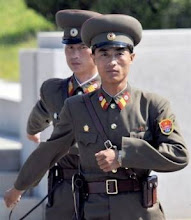

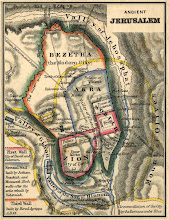

Divided Jerusalem

+and+Iran%27s+Ahmadinejad.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

+and+FM+Livni.jpg)

No comments:

Post a Comment